Credit Rating Notching . Web in the complex world of credit rating assessments, one concept that plays a pivotal role in evaluating the. It is a way to differentiate between foreign securities’. Web notching in finance refers to the practice of assigning distinct credit ratings to multiple securities or financial instruments issued. Web notching assigns credit ratings to debt instruments issued by the same issuer. Notching is a general practice by credit rating agencies to compare ratings of different issuers across a single. Web notching is the practice by credit rating agencies to give different credit ratings to the particular obligations or. Web notching is a practice by credit rating agencies to assign different credit ratings to specific debts or. Web for any given debt rating, its notching is measured relative to a baseline rating of the issuer which is typically either the senior.

from accratings.com

Web for any given debt rating, its notching is measured relative to a baseline rating of the issuer which is typically either the senior. Web in the complex world of credit rating assessments, one concept that plays a pivotal role in evaluating the. Notching is a general practice by credit rating agencies to compare ratings of different issuers across a single. Web notching is a practice by credit rating agencies to assign different credit ratings to specific debts or. Web notching in finance refers to the practice of assigning distinct credit ratings to multiple securities or financial instruments issued. Web notching is the practice by credit rating agencies to give different credit ratings to the particular obligations or. Web notching assigns credit ratings to debt instruments issued by the same issuer. It is a way to differentiate between foreign securities’.

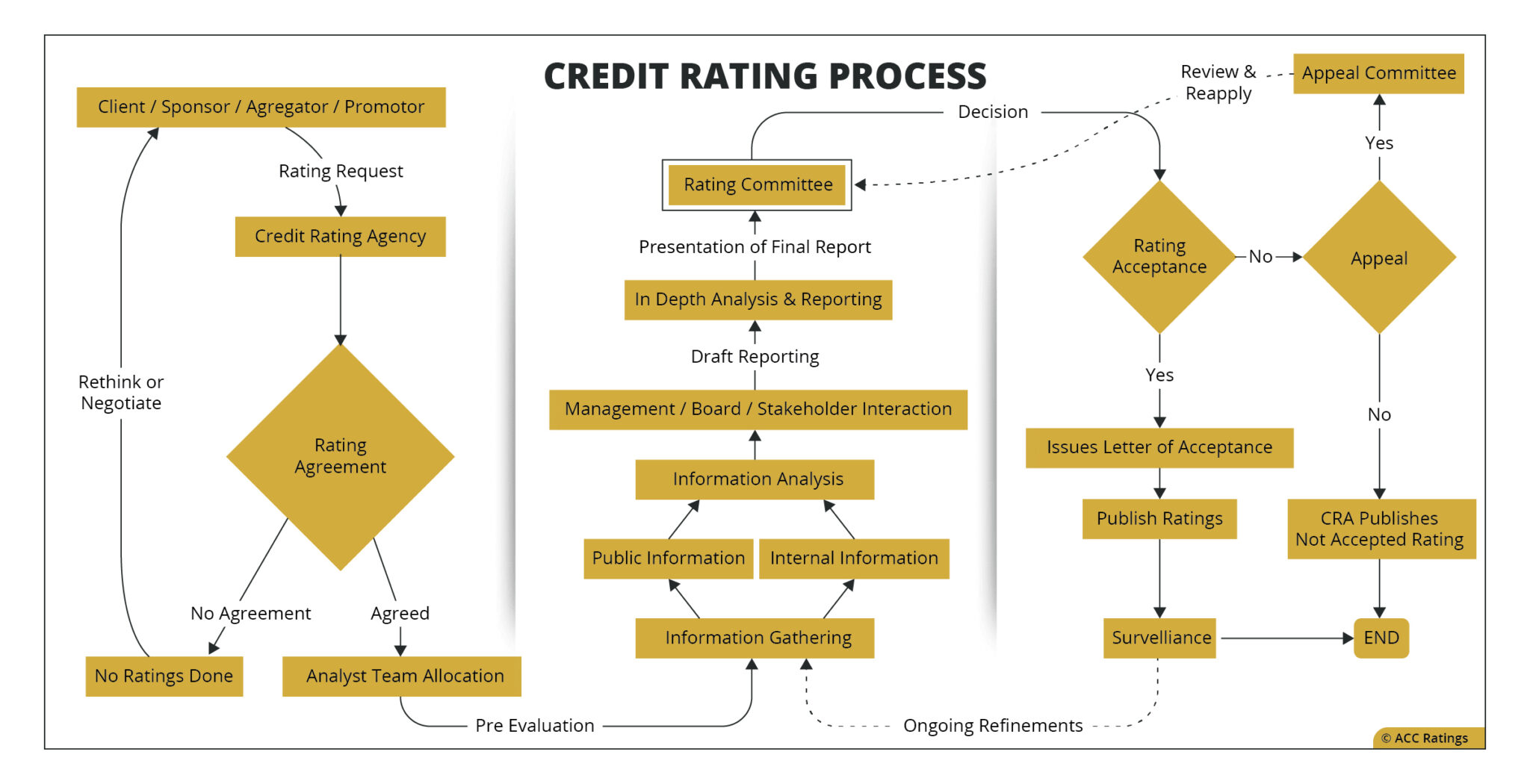

Credit Rating Process ACC Rating & Credit Advisors

Credit Rating Notching It is a way to differentiate between foreign securities’. Web in the complex world of credit rating assessments, one concept that plays a pivotal role in evaluating the. Web notching is a practice by credit rating agencies to assign different credit ratings to specific debts or. It is a way to differentiate between foreign securities’. Notching is a general practice by credit rating agencies to compare ratings of different issuers across a single. Web notching assigns credit ratings to debt instruments issued by the same issuer. Web for any given debt rating, its notching is measured relative to a baseline rating of the issuer which is typically either the senior. Web notching is the practice by credit rating agencies to give different credit ratings to the particular obligations or. Web notching in finance refers to the practice of assigning distinct credit ratings to multiple securities or financial instruments issued.

From www.spglobal.com

Credit Trends The Cost of a Notch S&P Global Credit Rating Notching Web notching is a practice by credit rating agencies to assign different credit ratings to specific debts or. Web in the complex world of credit rating assessments, one concept that plays a pivotal role in evaluating the. It is a way to differentiate between foreign securities’. Notching is a general practice by credit rating agencies to compare ratings of different. Credit Rating Notching.

From www.vectorstock.com

Credit rating infographic 10 steps concept Vector Image Credit Rating Notching Web notching is a practice by credit rating agencies to assign different credit ratings to specific debts or. Web in the complex world of credit rating assessments, one concept that plays a pivotal role in evaluating the. Web notching in finance refers to the practice of assigning distinct credit ratings to multiple securities or financial instruments issued. Web notching assigns. Credit Rating Notching.

From www.spglobal.com

Credit Trends The Cost of a Notch S&P Global Credit Rating Notching It is a way to differentiate between foreign securities’. Web notching in finance refers to the practice of assigning distinct credit ratings to multiple securities or financial instruments issued. Web notching is the practice by credit rating agencies to give different credit ratings to the particular obligations or. Web notching assigns credit ratings to debt instruments issued by the same. Credit Rating Notching.

From www.wallstreetmojo.com

Credit Rating What It Is, Scales, Types, Company, Examples Credit Rating Notching Web notching in finance refers to the practice of assigning distinct credit ratings to multiple securities or financial instruments issued. It is a way to differentiate between foreign securities’. Web notching assigns credit ratings to debt instruments issued by the same issuer. Web in the complex world of credit rating assessments, one concept that plays a pivotal role in evaluating. Credit Rating Notching.

From www.dreamstime.com

Bad Credit Score. Credit Rating Indicator in the Form of an Arrow of Credit Rating Notching Web notching assigns credit ratings to debt instruments issued by the same issuer. Web notching is the practice by credit rating agencies to give different credit ratings to the particular obligations or. Web in the complex world of credit rating assessments, one concept that plays a pivotal role in evaluating the. Web notching in finance refers to the practice of. Credit Rating Notching.

From breakingdownfinance.com

Credit ratings Breaking Down Finance Credit Rating Notching It is a way to differentiate between foreign securities’. Web for any given debt rating, its notching is measured relative to a baseline rating of the issuer which is typically either the senior. Web notching is a practice by credit rating agencies to assign different credit ratings to specific debts or. Web notching is the practice by credit rating agencies. Credit Rating Notching.

From www.fixedincomenews.com.au

Interpreting Credit Ratings What Do They Mean For Fixed Credit Rating Notching Web notching is a practice by credit rating agencies to assign different credit ratings to specific debts or. Web for any given debt rating, its notching is measured relative to a baseline rating of the issuer which is typically either the senior. Web notching assigns credit ratings to debt instruments issued by the same issuer. Notching is a general practice. Credit Rating Notching.

From bondevalue.com

Macy's Credit Rating Upgraded to BB+ BondEvalue Credit Rating Notching It is a way to differentiate between foreign securities’. Web for any given debt rating, its notching is measured relative to a baseline rating of the issuer which is typically either the senior. Web notching is the practice by credit rating agencies to give different credit ratings to the particular obligations or. Web notching is a practice by credit rating. Credit Rating Notching.

From slideplayer.com

Topic 5 Fundamentals of Credit Analysis ppt download Credit Rating Notching Web for any given debt rating, its notching is measured relative to a baseline rating of the issuer which is typically either the senior. Web notching assigns credit ratings to debt instruments issued by the same issuer. Web in the complex world of credit rating assessments, one concept that plays a pivotal role in evaluating the. It is a way. Credit Rating Notching.

From www.fe.training

Moody's Definition, How it Works, Credit Ratings Scale Credit Rating Notching Web notching is the practice by credit rating agencies to give different credit ratings to the particular obligations or. Web notching is a practice by credit rating agencies to assign different credit ratings to specific debts or. Web for any given debt rating, its notching is measured relative to a baseline rating of the issuer which is typically either the. Credit Rating Notching.

From www.investopedia.com

Corporate Credit Rating What it is, How it Works Credit Rating Notching It is a way to differentiate between foreign securities’. Notching is a general practice by credit rating agencies to compare ratings of different issuers across a single. Web notching in finance refers to the practice of assigning distinct credit ratings to multiple securities or financial instruments issued. Web for any given debt rating, its notching is measured relative to a. Credit Rating Notching.

From www.dreamstime.com

Bad Credit Score. Credit Rating Indicator in the Form of an Arrow of Credit Rating Notching Web notching in finance refers to the practice of assigning distinct credit ratings to multiple securities or financial instruments issued. Web in the complex world of credit rating assessments, one concept that plays a pivotal role in evaluating the. Web for any given debt rating, its notching is measured relative to a baseline rating of the issuer which is typically. Credit Rating Notching.

From www.alamy.com

Credit rating set of banners isolated on white background. Client Credit Rating Notching Web notching in finance refers to the practice of assigning distinct credit ratings to multiple securities or financial instruments issued. Web notching is a practice by credit rating agencies to assign different credit ratings to specific debts or. Web in the complex world of credit rating assessments, one concept that plays a pivotal role in evaluating the. It is a. Credit Rating Notching.

From www.mdpi.com

Economies Free FullText Moody’s Ratings Statistical Forecasting Credit Rating Notching Web notching assigns credit ratings to debt instruments issued by the same issuer. Web notching is the practice by credit rating agencies to give different credit ratings to the particular obligations or. Web notching in finance refers to the practice of assigning distinct credit ratings to multiple securities or financial instruments issued. Notching is a general practice by credit rating. Credit Rating Notching.

From www.financestrategists.com

Credit Ratings Meaning, Factors, Impact, Strategies, Agencies Credit Rating Notching Web notching is the practice by credit rating agencies to give different credit ratings to the particular obligations or. It is a way to differentiate between foreign securities’. Notching is a general practice by credit rating agencies to compare ratings of different issuers across a single. Web notching in finance refers to the practice of assigning distinct credit ratings to. Credit Rating Notching.

From www.spglobal.com

Credit Trends The Cost of a Notch S&P Global Credit Rating Notching It is a way to differentiate between foreign securities’. Web notching is the practice by credit rating agencies to give different credit ratings to the particular obligations or. Notching is a general practice by credit rating agencies to compare ratings of different issuers across a single. Web in the complex world of credit rating assessments, one concept that plays a. Credit Rating Notching.

From www.colourbox.com

Credit rating concept vector illustration. Stock vector Colourbox Credit Rating Notching Web notching is the practice by credit rating agencies to give different credit ratings to the particular obligations or. Web notching assigns credit ratings to debt instruments issued by the same issuer. Web in the complex world of credit rating assessments, one concept that plays a pivotal role in evaluating the. Web for any given debt rating, its notching is. Credit Rating Notching.

From fiinratings.vn

Rating Process FiinRating Credit Rating Notching Web for any given debt rating, its notching is measured relative to a baseline rating of the issuer which is typically either the senior. It is a way to differentiate between foreign securities’. Web notching is a practice by credit rating agencies to assign different credit ratings to specific debts or. Web notching is the practice by credit rating agencies. Credit Rating Notching.